In the ever-evolving landscape of ride-sharing services, Uber Technologies Inc. remains a significant player, revealing a complex financial narrative as it disclosed its fourth-quarter results. Despite showing an impressive year-over-year revenue increase, investor sentiment took a hit post-announcement, particularly as guidance for the upcoming quarter fell short of expectations.

Uber’s fourth-quarter performance painted a picture of resilience and robust growth. With earnings per share hitting $3.21, the figure starkly contrasts with the anticipated 50 cents, surprising analysts and demonstrating the company’s strong profit generation capabilities. Revenue reached an impressive $11.96 billion, slightly surpassing the $11.77 billion anticipated. This represents a remarkable 20% growth from the previous year’s $9.9 billion—a noteworthy achievement amidst the competitive ride-sharing market.

However, beneath this positive surface lies a reality shaped by one-time gains that bolstered the net income to $6.9 billion—significantly more than the $1.4 billion recorded last year. Notably, $6.4 billion of this amount stemmed from a tax valuation release, while $556 million arose from equity investment revaluations. Although these figures are indicative of effective financial maneuvering, they also raise questions about the sustainability of growth driven by extraordinary circumstances rather than core operational efficiency.

The softer guidance for the first quarter created a ripple effect in the stock market, leading to a near 7% decline in Uber’s shares during premarket trading. Uber anticipates gross bookings between $42 billion to $43.5 billion, falling short of the $43.51 billion projection by analysts. Furthermore, the anticipated adjusted EBITDA range of $1.79 billion to $1.89 billion also underwhelmed compared to the expected $1.85 billion. Such discrepancies between actual performance and forecasts can unsettle investors, highlighting the volatile nature of tech-based enterprises that are heavily reliant on future projections.

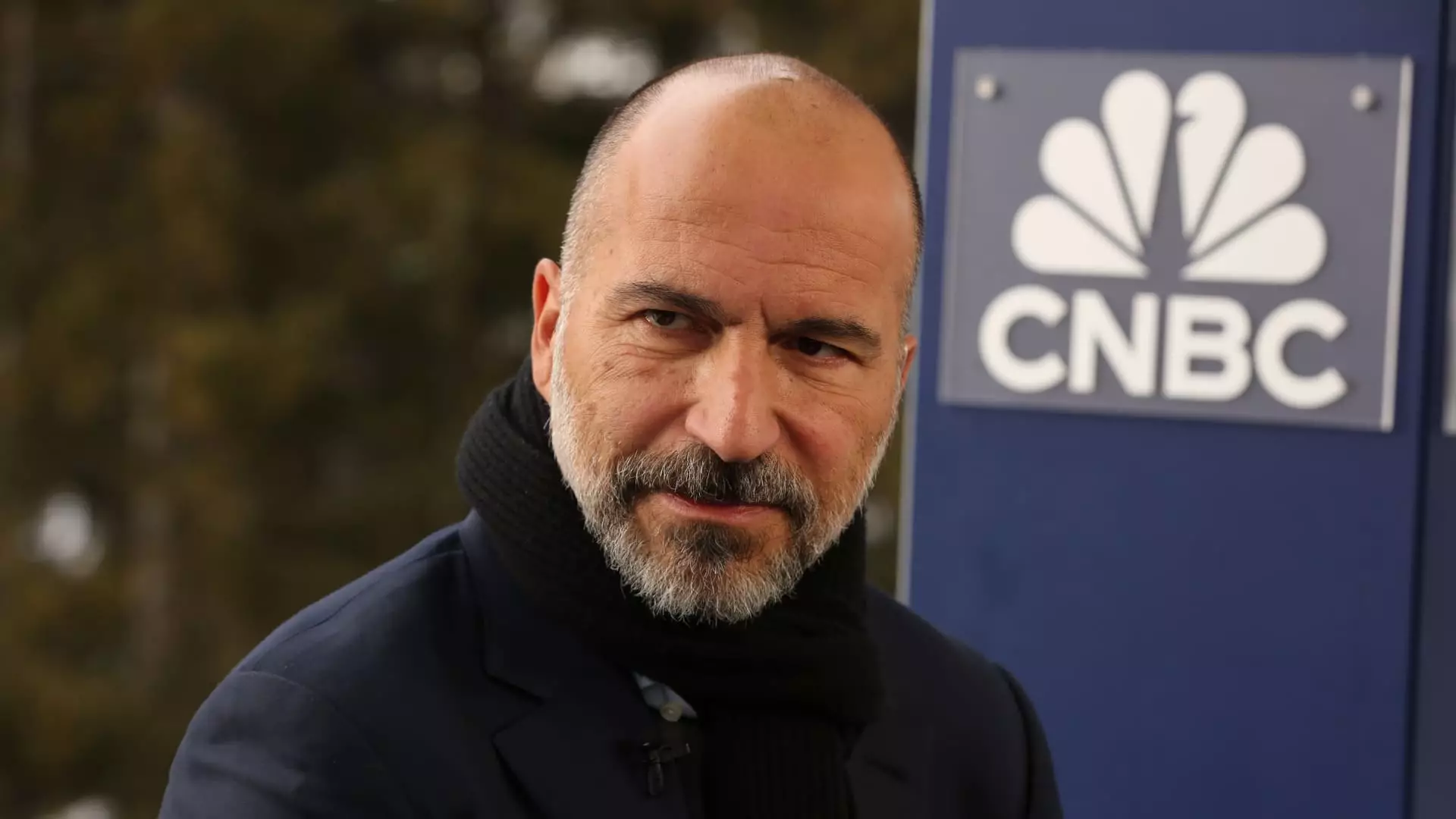

CEO Dara Khosrowshahi addressed the investor community with a promise of relentless focus on long-term strategies and numerous growth opportunities, particularly in autonomous vehicle technology. Yet, the challenge remains for Uber to translate these aspirations into tangible growth metrics that appease investors.

Diving deeper into Uber’s core operational segments reveals a robust performance across both mobility and delivery services, each reporting gross bookings of $22.8 billion and $20.1 billion, respectively. This reflects an 18% increase year over year for both segments, showcasing the company’s ability to maintain and expand its user base effectively. Revenue from mobility climbed to $6.91 billion, eclipsing expectations, while the delivery segment similarly outperformed analyst predictions with $3.77 billion in revenue.

However, not all areas are flourishing. Uber’s freight segment, stagnant at $1.28 billion, presents a contrasting story, remaining flat compared to the previous year. This stagnation may be attributed to shifting consumer habits favoring services over goods post-pandemic—a trend that poses ongoing challenges for the company.

Future Innovations: Robotaxi Launch

In a bid to stay ahead of the competition and innovate its service offerings, Uber announced its venture into autonomous vehicles with a forthcoming robotaxi service in Austin, Texas, in collaboration with Waymo. The introduction of this technology could radically alter the landscape of ride-sharing, steering the company into a new era of mobility services where human drivers may eventually become obsolete. By inviting consumers to join an interest list for rides with Waymo vehicles, Uber is strategically positioning itself as a pioneer in the robotaxi space.

A Turbulent Road Ahead

While Uber’s fourth-quarter financial performance features commendable revenue growth and profitability surprises, the underlying challenges pose significant questions about its trajectory. The mixed market response to guidance forecasts illustrates the precarious nature of investor confidence, heightened by uncertainties in the freight segment and overarching economic conditions. As the company ventures into autonomous driving and other avenues for innovation, the stakes are undeniably high. It will require expert navigation through fiscal challenges, competitive pressure, and the need for sustainable growth to maintain its stature in the ride-sharing industry.