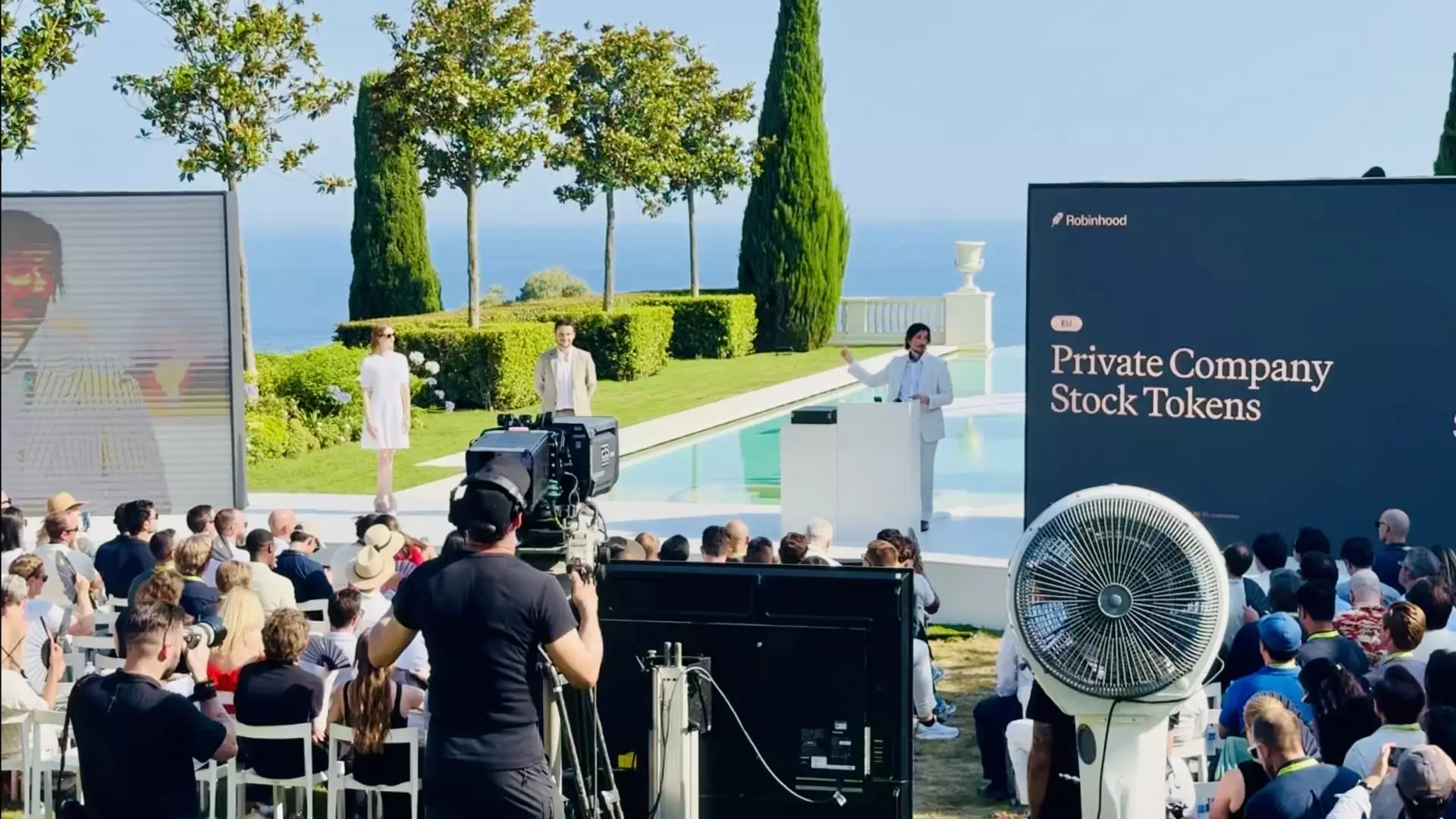

Robinhood’s recent unveiling at Cannes signals a bold transformation in how private equity can be accessed. By introducing tokenized shares of private giants OpenAI and SpaceX exclusively to European users, the company is tackling one of the long-standing barriers in finance—restricted access to elite investment opportunities. Traditionally, shares in such private firms have been confined to insiders or ultra-wealthy investors, perpetuating financial inequality. Robinhood’s move attempts to shake this exclusivity by leveraging blockchain technology to fractionalize ownership and open it to a broader audience. This is not merely an incremental product update; it’s a disruptive stride toward reimagining equity markets, empowering everyday investors to participate in ventures previously beyond reach.

The EU: A Regulatory Haven Catalyzing Innovation

A critical enabler of this innovation is Europe’s relatively flexible regulatory environment, notably its absence of stringent accredited investor restrictions that characterize other markets like the U.S. This regulatory latitude allows Robinhood to offer tokenized assets with greater inclusivity. Users on Robinhood’s EU crypto app can trade over 200 tokenized stocks and ETFs commission-free, around the clock on business days. Unlike conventional stock trading constrained by time and geography, this model democratizes access and amplifies liquidity. It also challenges the traditional gatekeeping role of financial intermediaries and regulators. Robinhood’s generous promotional campaign, distributing free tokens to onboard new users, exemplifies how tech can incentivize mass adoption of tokenized securities.

Strategic Crypto Infrastructure and User Empowerment

Technological underpinnings of this expansion are equally significant. Robinhood isn’t simply listing tokenized shares; it’s building an entire infrastructure ecosystem. This includes a proprietary custody wallet, safeguarding digital assets, and a new Layer 2 blockchain built on Arbitrum—known for its scalability and efficiency. By integrating these, Robinhood demonstrates a comprehensive vision that marries user security with seamless trading experience. However, this infrastructure rollout also carries inherent risks. Custody solutions and blockchain scalability are evolving fields, and user trust depends heavily on operational robustness and regulatory compliance. Robinhood’s ability to maintain transparency and security will ultimately determine whether this initiative transcends hype and sets a lasting precedent.

U.S. Market: Caution Amid Regulatory Complexities

Despite the enthusiasm in Europe, Robinhood’s U.S. launch remains stymied by regulatory hurdles. The U.S. Securities and Exchange Commission (SEC) maintains strict accredited investor rules, hindering tokenized private equity’s broader access. CEO Vlad Tenev’s public calls for regulatory reform highlight industry frustration, pointing to a disconnect between innovation’s pace and regulatory adaptation. While legislative evolution is notoriously slow, Robinhood’s stance signals the potential for blockchain to revolutionize private markets if regulatory frameworks can evolve. Meanwhile, the company is exploring alternative crypto opportunities stateside, such as reintroducing yield-bearing products like Ethereum and Solana staking, previously blocked by the SEC. This two-pronged strategy exhibits a pragmatic approach to innovation within existing legal confines.

Tokenization’s Broader Implications for Financial Democratization

Robinhood’s initiative transcends mere product innovation; it represents a critical shift in the financial ecosystem’s power dynamics. Tokenization inherently reduces entry barriers, improves liquidity, and can foster transparency by embedding asset ownership directly on blockchain ledgers. Yet, challenges remain. Regulatory frameworks worldwide must evolve in tandem to balance investor protection with enabling innovation. There is also the risk of hype overshadowing substance, with investors potentially misled by the allure of “fractional ownership” without fully grasping the associated risks or legal nuances of tokenized private shares. Robinhood’s move puts a spotlight on how tech firms are not just intermediaries but active participants challenging the status quo of wealth distribution in finance.

Despite these complexities, the direction is clear: democratizing access to private equity through blockchain tokenization holds transformative potential. Robinhood’s European rollout is an important litmus test for this future—proving that under the right regulatory and technological conditions, financial innovation can move beyond rhetoric to tangible impact on inclusion and opportunity. This initiative signals a future where traditional investment paradigms are not just disrupted but fundamentally redefined for a more equitable economy.