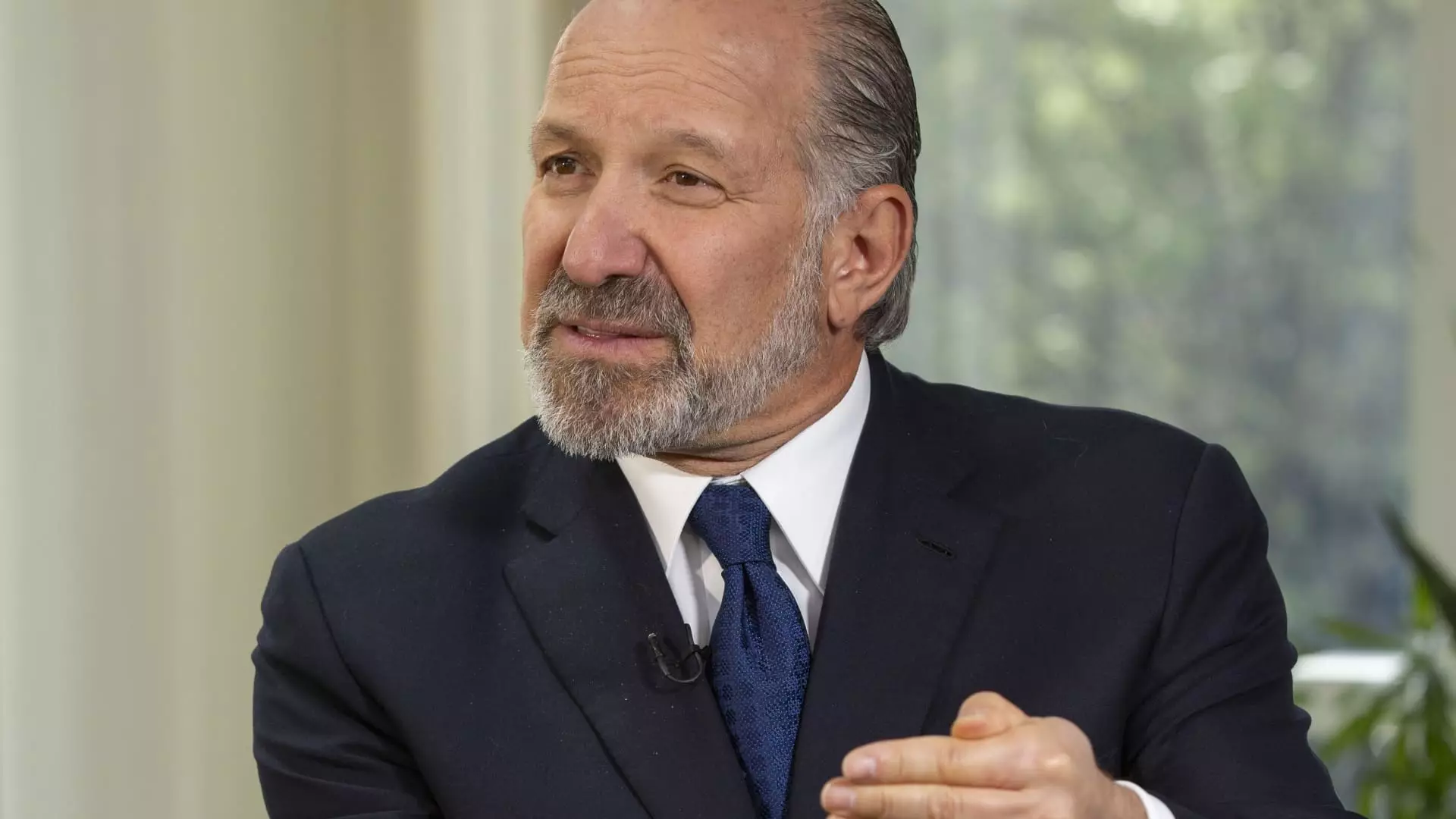

In a bold assertion of national economic interests, U.S. Commerce Secretary Howard Lutnick has championed the idea that American taxpayers should acquire an ownership stake in Intel—a move that signals a significant shift in how government and industry collaborate. Traditionally, government funding for technological advancements and manufacturing has been viewed as a way to spur innovation without entangling itself in corporate governance. However, Lutnick’s stance challenges this norm, proposing that the U.S. government must see direct financial benefits—namely, equity—when investing taxpayer dollars into critical industries like semiconductors.

This approach underscores a desire to transform grants and subsidies into tangible ownership stakes, effectively turning taxpayer funding into a tool for strategic leverage. It reflects an overarching belief that the government should not merely be a benefactor but also a stakeholder with a vested interest. Such a stance raises questions about the future role of government in shaping industry giants—will the cash infusion translate into control, or is this merely a pawn in the larger chess game of geopolitical power?

Implications for U.S. Industry and Global Competition

The discussion about acquiring equity in Intel surfaces amid broader concerns about America’s waning dominance in global semiconductor manufacturing. Despite billions in government grants awarded to Intel and TSMC, the U.S. still lags behind Asian competitors that have maintained a lead in chip production. The push for equity stakes could be viewed as a strategic move to ensure that taxpayer investment contributes directly to national security and economic resilience.

Furthermore, the White House’s purported interest in acquiring a 10% stake, which could position the U.S. as Intel’s largest shareholder, exemplifies an aggressive approach to reshoring manufacturing capabilities. Such a move would structurally alter the company’s ownership landscape, making the government a significant player—not just a benefactor—potentially influencing future corporate decisions. This scenario could set a precedent, encouraging other industries to seek similar contractual arrangements, blurring the line between public interest and private enterprise.

Economic and Ethical Considerations

However, this strategy is not without its dilemmas. Introducing government ownership into private sector companies raises fundamental questions about fairness, efficiency, and corporate independence. Lutnick’s insistence that the government’s stake would be non-voting and purely financial might placate concerns over government interference. Still, the optics of such moves could send mixed signals: is this a move to genuinely bolster industry competitiveness, or a subtle form of government intervention that risks distorting market dynamics?

Moreover, the debate sits against a backdrop of corporate struggles—Intel’s recent financial difficulties and leadership upheaval reflect the challenging environment facing the semiconductor sector. If the government begins to demand equity for its investments, it could deter private investment or complicate corporate governance, potentially stifling innovation rather than fostering it. The ethical question remains whether taxpayers should directly benefit from corporate successes or failures, and if such equity stakes align with long-term economic sustainability.

Ultimately, the emerging narrative illustrates a transformed landscape where economic strategy intersects with national security, raising the stakes for every stakeholder involved. As the U.S. seeks to reclaim its semiconductor supremacy, the methods it employs may redefine the entire fabric of industry-government relations for decades to come.