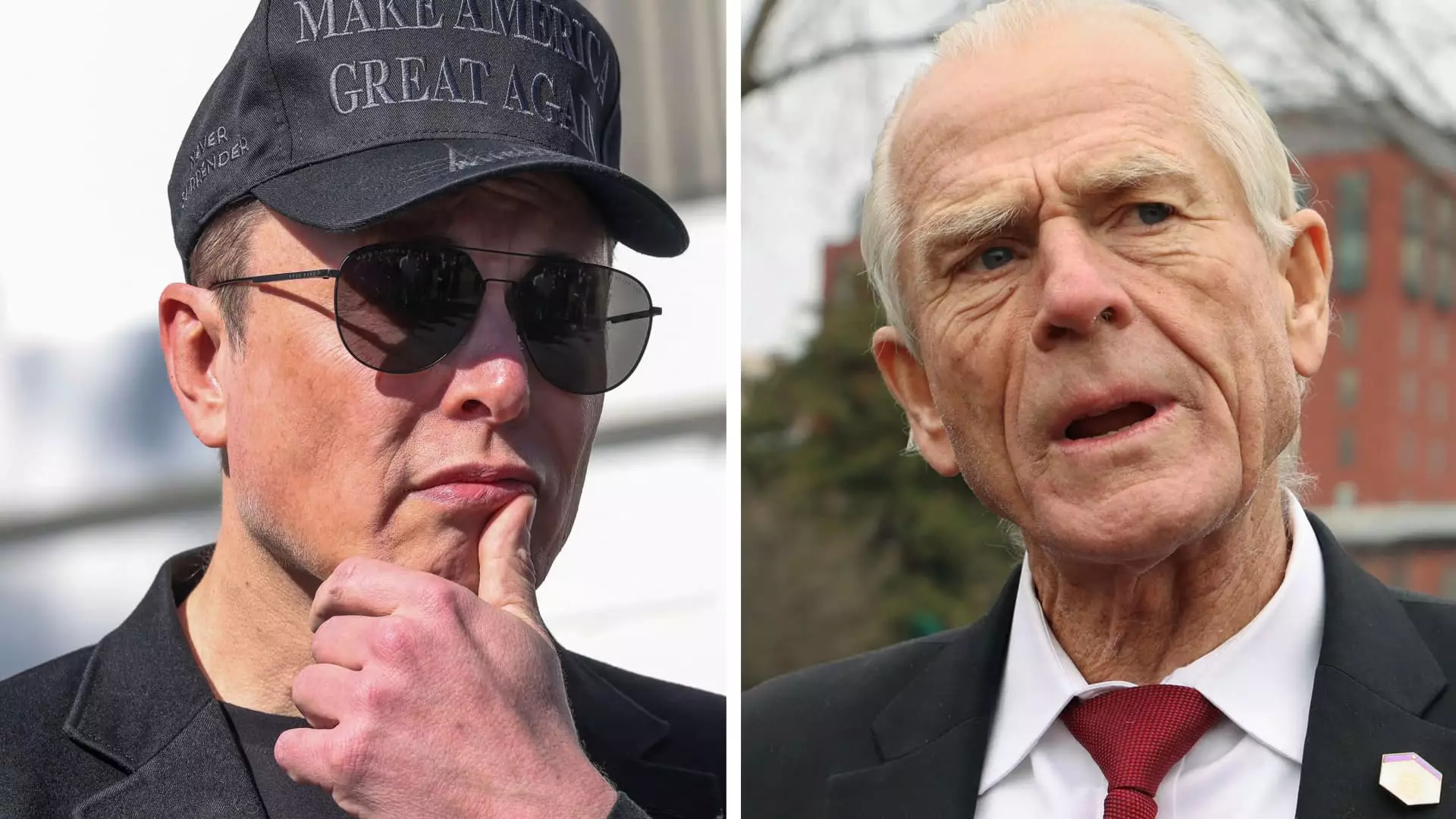

The recent skirmish between Tesla’s CEO Elon Musk and President Donald Trump’s trade advisor, Peter Navarro, epitomizes the precarious interplay between commerce and politics in contemporary America. As Tesla shares fell for the fourth consecutive day, Musk publicly accused Navarro of economic incompetence, dramatically illustrating how leadership can intersect with trade policies. The backlash against Navarro’s characterization of Tesla as merely a “car assembler” ignited Musk’s social media tirade, where he decried the status of Navarro’s PhD as a burden rather than a badge of honor.

Musk’s caustic wit serves as a reminder that at the intersection of innovation and regulatory frameworks, personal vendettas can erupt, leading to potential market repercussions. This highlights a concerning trend in which global industry leaders become embroiled in publicly contentious disputes that may affect consumer sentiment, leading to further volatility in stock prices.

The Reaction of a Fractured Administration

In the wake of Musk’s aggressive comments, White House Press Secretary Karoline Leavitt downplayed the friction, opting for a “boys will be boys” approach toward the discord between Musk and Navarro. This perspective not only trivializes the heavy consequences of their conflict but also points to the divisions within the Trump administration regarding economic policy. The stakes escalate, as tariffs introduced last week amplify existing tensions, impacting not just Tesla’s bottom line but also the broader automotive industry.

Musk’s outbursts indicate a growing discontent regarding protectionist policies being deployed by government officials he had previously supported. As Tesla’s stock continues to plummet—down 22% in just four days and shedding $585 billion in market value this year—the implications of such trade polarities could misplace the economic equilibrium for a company reliant on international supply chains.

The Broader Economic Context of Tariffs

Musk’s disdain for the tariffs reveals his recognition of their potentially damaging domains. Much of Tesla’s raw materials come from foreign nations; Canada and Mexico stand out among the significant importers of steel and aluminum. As the tariffs increase production costs, a critical question emerges: how will Tesla navigate this intricate landscape when contending with both dwindling stock prices and competitive pressures from rivals?

Musk’s advocacy for a free trade zone between Europe and North America markedly contradicts the growing trend of protectionism sweeping through certain sectors of the government. His remarks connect directly to the strategic positioning of Tesla’s new plant near Berlin, which symbolizes the deep entanglement of his business interests with geopolitical economies. Musk’s penchant for free trade is not just philosophical but also foundational to the logistical success of Tesla in multiple significant markets.

Market Reactions and Internal Challenges

The tumultuous drop in Tesla’s stock illustrates not only external pressures—such as regulatory environments and tariffs—but also internal inefficiencies. The recent report of a 13% decline in first-quarter deliveries raises alarms among shareholders and analysts alike, pointing to an organization struggling to navigate oscillating consumer demand amidst a complex economic backdrop. Missing analysts’ estimates poses legitimate concerns about Musk’s management strategies and operational execution.

As protests and boycotts become synonymous with Tesla’s branding, Musk’s political engagements bear responsibility for tarnishing the company’s image and hindering its performance metrics. In retrospect, a juxtaposition of his aggressive rhetoric and the political decisions he underpins reminiscent of a heavyweight boxer whose blows are self-inflicted. The spotlight on Musk’s outward expression risks overshadowing the innovations Tesla is renowned for, illustrating a scenario where personal ambition could compromise corporate integrity.

The Reality of Consequences

Though Musk remains an audacious figure in tech, pushing the boundaries of possibility, the narrative woven by his recent conflict with Navarro is one of stark reality: personal clashes in the public domain can reverberate throughout the business sector. These episodes serve as potent reminders of how entangled global market dynamics are with individual egos and governmental actions.

The ramifications may be profound—a daily erosion of Tesla’s market capitalization may lead to belated reflections on the necessity of careful deliberation, both within corporate strategies and political directives. Meanwhile, while Musk’s charisma and brilliance in technological innovation are undeniable, one must ponder the extent of damage personal battles on social media can inflict on an empire built on cutting-edge advancements. The stakes have never been higher, and the rule of thumb for influencers of Musk’s stature remains: choose battles wisely.