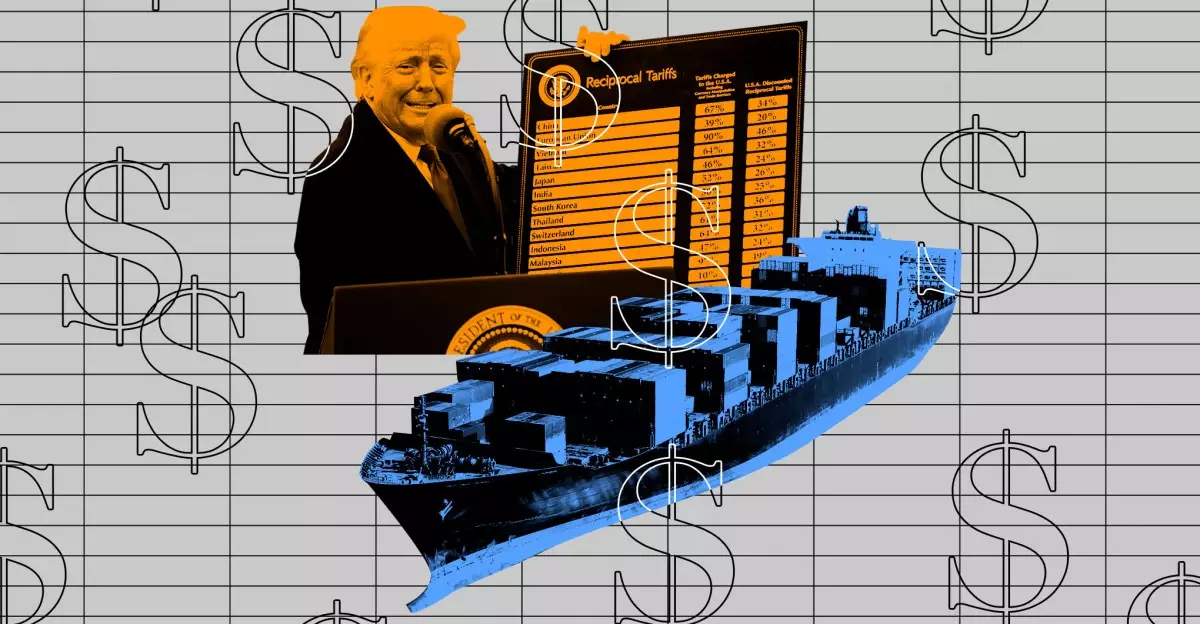

The ongoing saga of tariffs related to Chinese imports has taken an unexpected turn as recent updates from US Customs and Border Protection (CBP) reveal an exemption for essential consumer tech. This new guidance excludes a variety of electronics, including smartphones, laptops, and key components, allowing these products to bypass significant additional tariffs imposed under the previous administration. The implications of such changes are far-reaching and suggest a more supportive environment for the tech sector amidst a turbulent trade atmosphere.

In a strategic move, the current administration rolled back certain measures that previously burdened popular consumer technology imports. These exemptions, while a welcome relief for tech companies and consumers alike, do not erase all tariff obligations. Many electronics still face pre-existing tariffs, but the omission of high-profile items like smartphones and laptops from the heavy 125 percent tariff is a strong signal of potential stabilization in the import market.

The Impacts on Consumer Prices and Market Strategy

The exemption from these tariffs comes at a crucial time when consumer prices were anticipated to rise due to the trade tensions between the US and China. Reports from industry leaders, such as Sony and OnePlus, indicate that many companies were already factoring increased costs into their pricing strategies. The idea that tech giants would pass on these tariffs to consumers manifested in the price adjustments witnessed during the rollout of new products.

For instance, Sony incorporated higher production costs into the retail prices of its latest televisions, while OnePlus, without explicit justification, raised prices on its smartwatches. Such strategic pricing signals how deeply intertwined market maneuvers have become with the whims of trade policies, reflecting a cautious approach as businesses navigate the uncertain waters of tariff-driven market conditions.

Exemptions: Economic Relief or Just a Temporary Band-Aid?

While the newly published guidelines offer significant economic relief for a variety of consumer tech imports, it’s critical to assess the broader context. The White House memo accompanying the CBP’s update highlighted that while some duties on electronics may be eased, a separate 20 percent duty remains in place to pressure China regarding issues like fentanyl. This ambiguity raises questions about the permanence and reliability of these exemptions.

Moreover, the lack of clarity in the policy shift does little to reassure manufacturers and consumers who may still bear the brunt of inflationary trends. The trade environment is characterized by unpredictability, and as companies continue to adjust their operations—such as Apple’s significant rush to import additional iPhones from India—there’s an underlying sense of instability that these exemptions do not fully resolve.

Adaptability in an Evolving Market

As the tech ecosystem grapples with these developments, companies are discovering new pathways for optimization and resilience. For instance, the decision by Nintendo to delay preorders for the much-anticipated Switch 2 demonstrates an adaptable business strategy amid uncertainty regarding tariff impacts on consumer gaming products. Maintaining a steadfast launch price showcases a willingness to hedge against potential price hikes caused by tariffs, revealing a trend towards strategic cost management.

The improved regulatory clarity surrounding tech imports may usher in a renewed focus on innovation and competition, enabling companies to concentrate less on price adjustments and more on enhancing product quality and consumer experience. This cost relief could serve as a liberating force, unlocking resources for advanced research and development initiatives, pushing the boundaries of technology innovation.

A Future of Collaborative Trade Relations

Ultimately, the exemptions granted by US Customs and Border Protection might hint at a forward-thinking strategy aimed at fostering collaborative trade relations rather than punitive measures. The essence of the consumer tech industry lies in its ability to innovate and adapt, qualities that may become even more critical as these tariffs shape the industry’s landscape.

Moving forward, the hope is that the trade strategies will evolve to prioritize constructive engagement rather than the imposition of punitive tariffs—a sentiment that resonates throughout both Washington and Silicon Valley. Businesses must remain vigilant, navigating an increasingly complex global market, where agile decision-making will be essential to thrive in the evolving trade narrative.