The landscape of venture capital in the United States is meticulously evolving, with numerous unicorns—startups valued at over $1 billion—anticipated to navigate the transition to public markets in 2025. The fourth-quarter insights from the PitchBook/NVCA Venture Monitor paint a multifaceted picture of the current startup ecosystem and its prospective trajectory.

At the forefront of analytics in venture capital, PitchBook utilizes machine learning to develop a VC exit predictor tool, evaluating startups on their potential for successful exits, whether through acquisition or public offerings. This innovative approach gathers data on financing rounds and investor behaviors to offer a quantified assessment of companies’ likelihoods of crossing various exit thresholds. Startups receive percentage scores reflecting their potential outcomes—ranging from acquisition to self-sustainability. By employing proprietary methodologies, including those previously established for mergers and acquisitions, PitchBook aims to provide a clear lens into the exit values of venture capital investments.

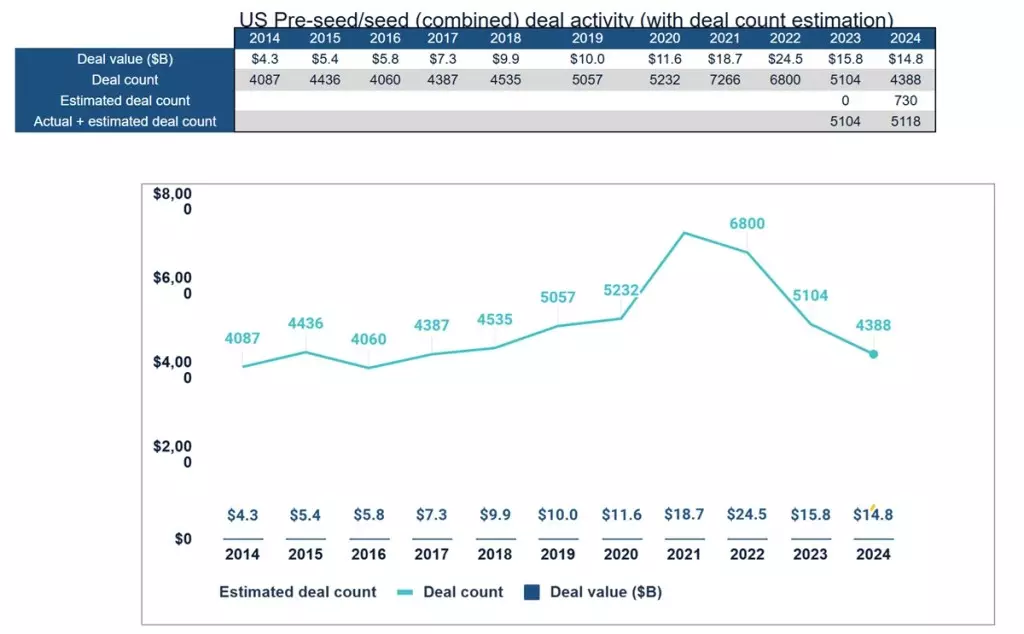

The current statistics suggest a modest yet encouraging trend, as companies with significant backing—especially in the AI sector—continue to secure large valuations, even amidst a backdrop of broader industry challenges. Despite these promising indicators, the venture capital market is simultaneously grappling with underlying issues that hinder a more robust growth trajectory.

Nizar Tarhuni, the Executive Vice President of research and market intelligence at PitchBook, highlights the juxtaposition of rising completed financings against a stark reality of limited exit success. He notes that a mismatch in buyer and seller valuations—a lingering effect of inflated funding rounds from previous years—alongside regulatory restrictions, are key elements stunting growth and confidence in the market. As businesses wrestle with these headwinds, innate problems surrounding valuations and expected outcomes have made fundraising efforts pedestrian at best.

Despite these challenges, Tarhuni expresses cautious optimism for the following year. A potential easing of regulatory pressures in Washington, D.C., could encourage a revival of investor interest and capital flow. Still, the competition for the financial resources of venture capitalists may persist, as alternative investment avenues gain traction, making the terrain tougher, especially for early-stage startups.

Signs of Resilience and Adaptation

Bobby Franklin, CEO of NVCA, echoes this cautious outlook, emphasizing a recent surge in investment levels—the highest since mid-2022—combined with a delicate hope for the venture capital ecosystem. Franklin points to shifting leadership within key regulatory bodies like the FTC and DOJ, which may relieve some liquidity strain for portfolio companies. Additionally, he emphasizes that the ongoing tax reform discussions in Congress represent a crucial opportunity to foster innovation, reinstating pivotal incentives for research and development.

This coming year will certainly test the resilience of the venture industry, but there are innovations in regulations and leadership that could potentially recalibrate perspectives for investors and startups alike. Grassroots mobilization efforts by VCs—driving dialogues on Capitol Hill—could enhance the visibility of venture-backed firms as valuable contributors to America’s economic vitality.

Predictions about specific unicorns poised for public offering reveal several notable names heading into 2025. For instance, Anduril, recognized for its cutting-edge work in aerospace and defense, holds a staggering 97% chance of going public—an outcome likely influenced by its founder, respected entrepreneur Palmer Luckey. Similarly, Mythical Games, a key player in Web3 gaming, shares this optimistic projection. Other notable companies, including Impossible Foods, SpaceX, and Databricks, are also pegged as likely candidates for IPOs, reflecting the diversity of industries represented among the anticipated future public offerings.

While the pathway to IPO may seem strewn with challenges, the potential for a flourishing 2025 remains. High prognostic valuations and strategic recalibrations could catalyze a rejuvenated venture capital landscape, reinvigorating investor confidence and fueling the next wave of innovation-led growth across the country. The year ahead not only holds promise for unicorns but also serves as a critical juncture for the entire startup ecosystem, as it seeks to realign itself with changing market dynamics and expectations.