In recent years, the emergence of cashierless checkout technologies has dramatically changed the landscape of retail. As the pandemic forced many businesses to adapt or perish, startups like Grabango sought to revolutionize the shopping experience by utilizing advanced technologies such as machine learning and computer vision. However, the lofty ambitions of such companies often clash with reality, especially when they are unable to secure sufficient funding or endure market fluctuations. Grabango’s recent shutdown serves as a stark reminder of the challenges faced by innovative startups in a competitive environment dominated by established giants.

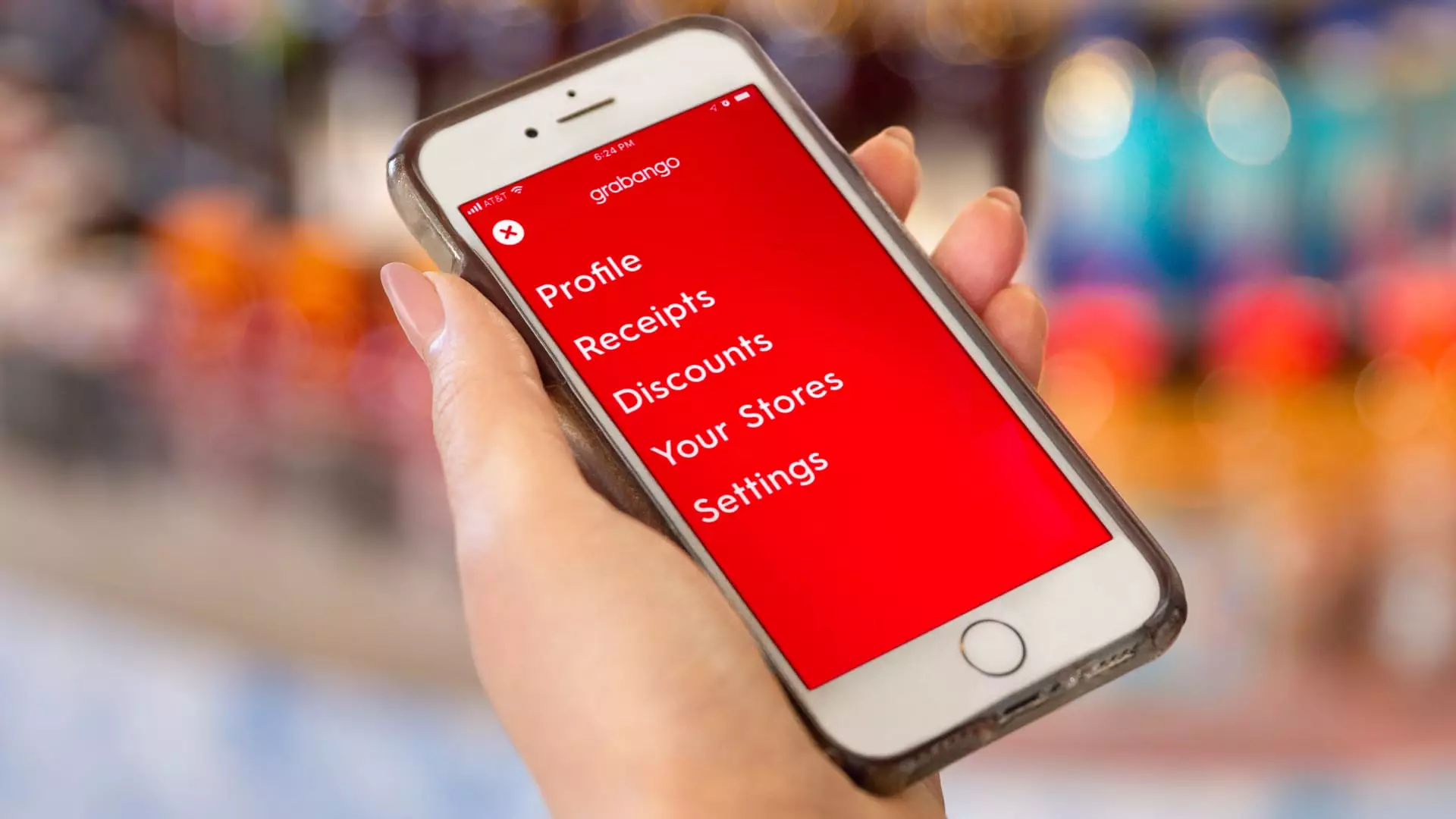

Founded in 2016 by Will Glaser, a seasoned technologist known for co-founding the music streaming service Pandora, Grabango set out to create a cutting-edge checkout-free shopping experience. Through the use of sophisticated technologies, the startup aimed to develop a system capable of seamlessly tracking shoppers as they moved through stores, automatically tallying their selections without the need for traditional checkout processes. In a market often dominated by players like Amazon, which introduced its Just Walk Out technology, Grabango sought to carve out its niche by differentiating itself through innovation.

In its brief life, Grabango attracted considerable investment, raising over $73 million from various venture firms. Included among these were notable investors such as Peter Thiel’s Founders Fund and the venture arms of both Unilever and Honeywell. Despite these initial successes, as competitive pressures mounted and market conditions shifted, Grabango struggled to maintain momentum and secure additional funds.

The Funding Dilemma

As 2022 transitioned into 2023, the venture capital landscape experienced a significant downturn, effectively stifling the fintech and tech startup sectors. With a few exceptions, like generative AI firms, the broader market experienced a freeze in funding, leading many startups to rethink their strategies or face closure. For Grabango, this meant re-evaluating its ambitious plans for growth, including a projected IPO worth between $10 billion to $15 billion.

A representative from the company cited the failure to secure needed funds as the main reason for its closure, indicating that Grabango’s efforts to innovate in the checkout sector were hindered by prevailing economic conditions. While many start-ups may have the vision and necessary technology, the brutal reality is that without the financial backing, many will ultimately falter, as Grabango sadly did.

The competition in the cashierless technology arena became increasingly fierce. Grabango had developed partnerships with well-known grocery chains such as Aldi and Giant Eagle, as well as convenience store leaders including 7-Eleven and Circle K. However, Amazon’s expansive reach and aggressive marketing of its Just Walk Out technology posed a significant threat. In a recently published remark, Glaser noted that Amazon’s reliance on shelf sensors had created vulnerabilities within its own system.

This competition narrowed Grabango’s chances of thriving, forcing it into a constant cycle of innovation and adaptation to stay relevant against a behemoth competitor with extensive resources. As more retailers turned toward Amazon, Grabango’s offerings began to lose traction.

The winding tale of Grabango serves to highlight vital lessons for both investors and entrepreneurs. Firstly, even with impressive technology and initial backing, the ability to sustain growth through financial backing is essential. The tech landscape is unforgiving, and startups must remain vigilant about their funding strategies to weather market fluctuations.

Secondly, the competition should not be underestimated. With giants like Amazon continually evolving and mitigating any perceived weaknesses, smaller companies must be agile and responsive to shifts in the marketplace. They must learn to embrace flexibility rather than rely solely on initial successes.

Finally, the situation reminds us of the transient nature of innovation in the tech industry. Despite its groundbreaking vision and the potential to redefine shopping experiences, Grabango’s closure illustrates the precarious balance between ambition, financial health, and market positioning.

Grabango’s attempt to become a leader in cashierless technology ended in an unceremonious shutdown, yet it stands as a poignant example of the challenges faced by tech startups. In an era where innovation is key, the financial backing, competitive acumen, and adaptability are woven into the fabric of success. The dream of a seamless, checkout-free shopping experience continues to unveil, but as Grabango has shown, vision alone is not sufficient for long-term success in the harsh, evolving retail landscape.