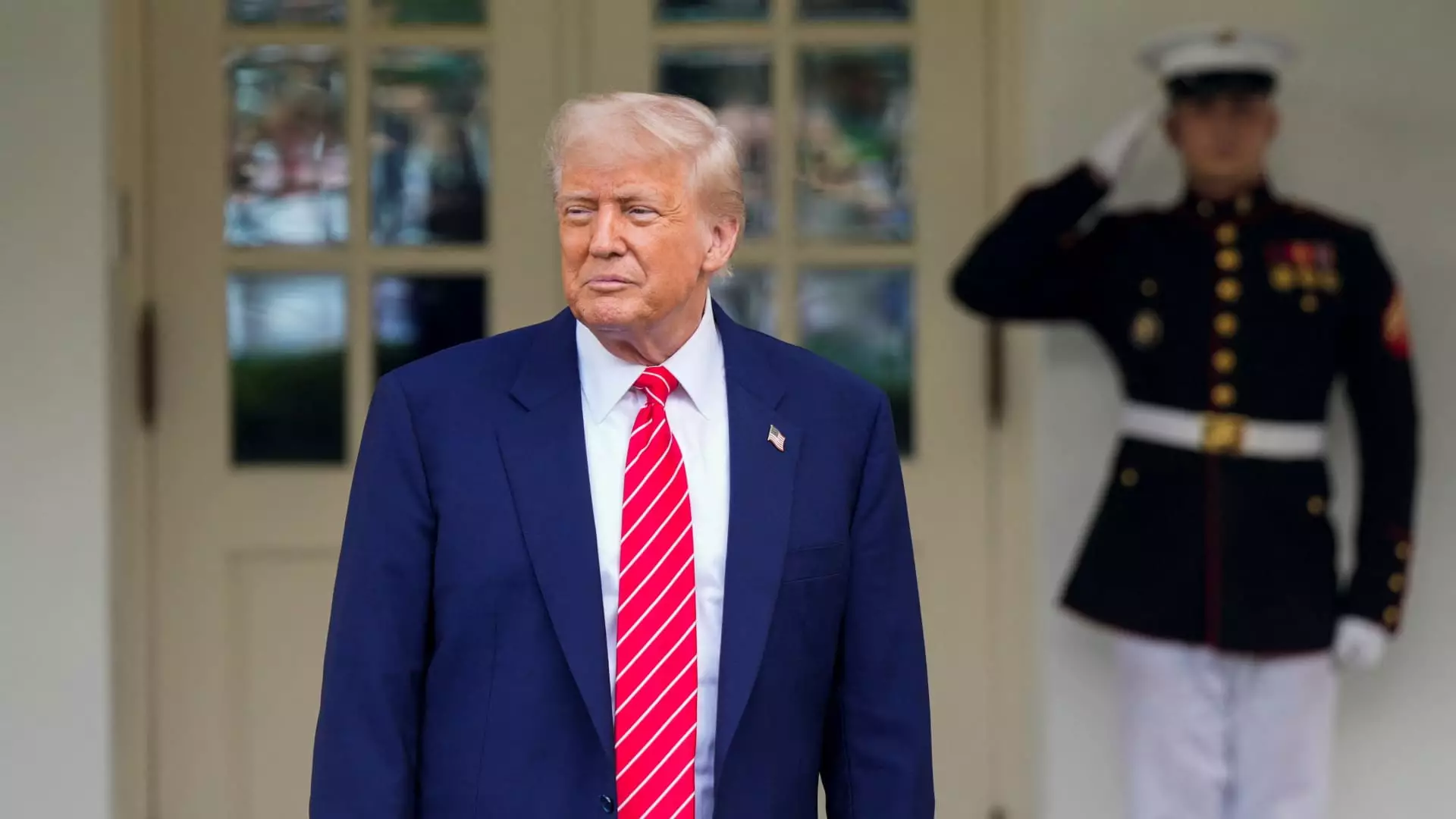

In a political environment riddled with complexities, few issues encapsulate the contentious intersection of personal interests and public service like cryptocurrency legislation under President Donald Trump. The recent rejection of the GENIUS Act—a legislative attempt to regulate stablecoins—has revealed alarming complications stemming from Trump’s financial entanglements in the digital currency space. Critics argue that the personal and national interests have become inseparably intertwined, effectively crippling efforts to establish a coherent regulatory framework for this emerging financial sector. Senate opposition to the GENIUS Act, led by figures like Senator Jeff Merkley (D-Ore.), highlighted concerns about potential corruption and national security risks posed by the president’s cryptocurrency ventures.

Stablecoins and National Security

At the heart of the legislative battle lies the concept of stablecoins, digital currencies pegged to real-world assets, such as the U.S. dollar. Proponents argue that stablecoins hold enormous potential for economic innovation, providing more stability and efficiency than traditional cryptocurrencies. However, the potential for misuse and illegal activities—especially regarding money laundering and foreign investments—remains a significant concern. The reluctance of nine Senate Democrats to support the GENIUS Act stems from fears that inadequate protections could facilitate nefarious activities under a loose regulatory framework. This dissent underscores a broader anxiety that comprehensive legislation is essential not only for consumer protection but also for safeguarding national interests in an increasingly digitized world.

A Bipartisan Lost Opportunity

The failure of the GENIUS Act brought a rare opportunity for bipartisan cooperation crashing down. Initially, there appeared to be enough support to push this legislation through, representing a chance for Trump to gain political capital by delivering a much-needed regulatory framework for the burgeoning crypto industry. Yet, that hope was thwarted by concerns over Trump’s involvement in the cryptocurrency sphere. The emergence of $TRUMP and $MELANIA coins—alongside the family’s venture into World Liberty Financial, which launched its own stablecoin—has raised eyebrows and spurred claims of a “pay-for-play” scheme.

Senator Richard Blumenthal (D-Conn.) did not mince words, calling the president’s actions a blatant conflict of interest. Such scenarios not only jeopardize legislation but also risk eroding public trust in the government. For those in the crypto sector hoping for clarity and rules that could advance business interests, the president’s ongoing personal financial interests represent a huge impediment.

The Push for Anti-Corruption Laws

In response to the mounting issues surrounding Trump’s crypto dealings, Senate Democrats introduced the “End Crypto Corruption Act.” This legislation seeks to block elected officials and senior governmental personnel from endorsing digital currencies, emphasizing accountability in an era fueled by innovation and rapid change. The existence of such a bill indicates that lawmakers are not only responding to Trump’s activities but are also keenly aware of the larger ethical implications involved. Dramatic intersections of politics and personal business ventures require vigilant oversight, particularly when they intersect with burgeoning financial sectors like cryptocurrencies.

The Ripple Effects on the Crypto Industry

The repercussions of this legislative debacle extend beyond the GENIUS Act itself, shaking the foundations of future policy decisions concerning cryptocurrencies. With the crypto lobby having emerged as a significant player in political funding—especially for Trump’s 2024 campaign—regulatory efforts risk being overshadowed by personal greed and political machinations. Investors and entrepreneurs in the sector express frustration at what they perceive as a real risk to their aspirations for growth and innovation. Ryan Gilbert, founder of fintech venture fund Launchpad Capital, laments that personal gains should not stand in the way of meaningful regulation.

The ripple effect is evident; the longer Congress remains mired in conflict and confusion, the more the global perception of the U.S. crypto industry suffers. Gilbert warns that America could become “the laughing stock of the world” if these conflicts persist, steering potential investments away from a promising technology sector.

A Call for Integrity and Transparency

Ultimately, the situation surrounding Trump’s involvement in cryptocurrency legislation serves as a potent illustration of how personal interests can disrupt public policy. As lawmakers grapple with the implications of incorporating personal profit into legislative efforts, the call for integrity and transparency becomes increasingly urgent. The ramifications of these controversies extend far beyond Capitol Hill, influencing the way citizens perceive their government and its capacity to foster progressive economic strategies. As the digital currency landscape continues to evolve, the importance of maintaining public trust cannot be overstated. For the promises of cryptocurrency to be actualized, elected officials must prioritize the collective good over personal gains.